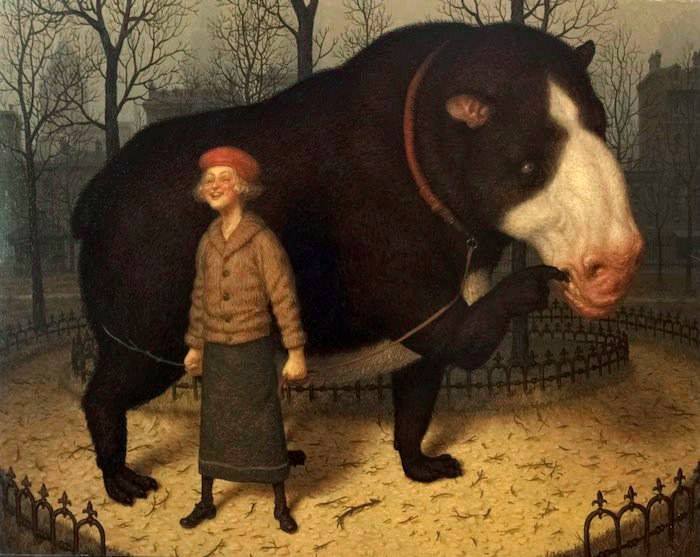

New work from Peter Ferguson, “Promenade”. This painting is going to be on exhibition at the LA Art Show (Jan 15-19, LA Convention Center) through Roq La Rue Gallery in Seattle, so if you happen to be in the LA area mid-January, you should check out Peter’s painting in the flesh. You can see more of his work on www.peterfergusonart.com.

Apparently Peter’s having a solo show at Roq la Rue in April… stay tuned, I will provide details as soon as I learn more!

It’s Christmas time again, and as always, I have made cards and sent them off. If you’re not on my print version mailing list, here’s the digital version to spread seasonal joy and soforth. I DEMAND THAT YOU BE MERRY AND BRIGHT. But seriously, Merry Christmas everyone. Enjoy your holidays in whatever form they may take.

Usually I spend a lot of time writing about modern and contemporary art, the art market, art theory, and that sort of thing. You know, more or less current concerns relating to art. One thing that I haven’t mentioned before is that I have a Master’s degree in art education and spent many years looking at art made by kids. I find it fascinating how there is a timelessness to many of the representational methods kids use and how their artistic development parallels their cognitive development. One thing that I find particularly interesting is how subject matter changes from generation to generation – kids get their subject matter from their surroundings & contemporary cultural influences. Kids at my daughter’s school make drawings of video game interfaces of their own invention, characters from cartoons they like, or fantasy bedrooms stocked with computers and gaming stations. One might wonder what kids drew in, say, the Middle Ages. Enter Onfim, an approximately 7-year-old Russian boy, alive somewhere between the 12th and 13th century. Kids in medieval Russia learned how to write on scraps of birchbark. Somehow a whole stack of these were preserved and discovered by archaeologists in the 1950’s, including a bunch of drawings by Onfim who apparently enjoyed drawing when he got bored of practicing his letters.

In the 13th century, young schoolboys learning to write filled these scraps with alphabets and short texts. Bark was ideal material for writing down things with such a short half-life. Then the pupils got bored and started to doodle, as kids do… The snippets provide a delightful and most unusual peek into a 13th-century classroom, with kids learning to read – and getting bored in the process.

Onfim was being taught to write, but he was obviously restless with his lessons and when he could get away with it, he intermixed his assignments with doodlings. In this first example, he started to write out the first eleven letters of the alphabet in the upper right corner, but got bored and drew a picture of himself as a grown-up warrior impaling an enemy with his spear. To remove any doubt about the identity of the warrior, he even labeled the person on the horse as “Onfim.”

Onfim also made drawings of the people in his life, including this great one of his parents:

While checking out actual drawings by a little kid from medieval Russia is awesome, what’s really amazing is how kids drawings still look pretty much the same.

If you would like to see more drawings by Onfim you can do so here, or if you’d like to learn more about the excavation in general you can go here (which is also where I got the two images shown here).

Is the Art Market About to Crash Again?

The prices being fetched for fine art at auction these days are, to put it frankly, mind-boggling. According to Artprice, a French company that tracks the global art market, the total value of all works sold June 2012 to June 2013 was $1.4 billion USD. To put that in perspective, the 54,000 square foot Museum of Arts & Design in midtown Manhattan only cost $65 million USD to build.

There is some worry about overvaluation – basically, the concern that buyers are picking up pieces based on their value as a commodity rather than their value as art, creating a market based entirely on perceived value rather than underlying or long-term value. Basically, how trendy an artist is on the auction block as opposed to their relevance to art history. Damien Hirst is an artist people often point out whose work sells for millions at a go but is essentially without any kind of craft. Think of his famous cow & calf preserved in formaldehyde, “Mother and Child Divided”, or his equally well-known spot paintings.

Damien Hirst – Mother and Child (Divided)

Damien Hirst – Abalone Acetone Powder

Historical footnote: This is an excerpt from an op-ed by Germaine Greer on the inability of the art critic Robert Hughes to grasp Damien Hirst’s work. It was written shortly before the collapse of the art market in November of 2008, when prices fetched at auction for fine art dropped by as much as 30%. While Hirst is seen as a great marketer, as Greer points out, if the point of art is marketing, it is subject to the market. In the 2008 crash, stock in Sotheby’s dropped to $9 a share from $50 a share the year previous. To some extent this came as a surprise to art dealers, who had maintained that the art market was more or less immune to the vagaries of the stock market. When the cascading effect of the real estate bubble’s collapse crashed the stock market, the art market turned out to be less invulnerable than previously imagined. Word on the street is that Hirst only maintained his auction prices by buying his own work in tandem with a consortium of like-minded art investors driving up the market. While shill bidders are nothing new in the art world, it was a ballsy move equivalent to a gang of confidence men running a long grift. That aside, the recovery of the art market since the crash has surpassed its former glory – in spades.

Artnet – Collecting Categories Performance 2009-2012

On November 12, 2013, Francis Bacon’s 1969 triptych “Three Studies of Lucien Freud” broke the record for the highest price ever fetched at an art auction, sold by Christie’s for $142.2 million USD. In the same auction, Jeff Koons became the highest-grossing living artist, with one of his sculptures, a monumental stainless steel reproduction of a balloon dog, selling for $58.4 million USD. Gerhard Richter is right behind Koons – in May his 1968 painting “Domplatz, Mailand” sold for 37.1 million USD, in 2012 his painting “Abstraktes Bild” sold for $34 million USD.

Jeff Koons – Balloon Dog (Orange) on display at Christie’s

A balloon dog! Made of steel! And really big! Genius. While Koons has been out-Hirsting Hirst in terms of bringing work to market for decades that has no value other than a sophisticated one-liner “get it?” at the expense of the art market, this takes the cake. It is so obviously and unashamedly a joke that only the most self-involved connoisseur or strictly money-hungry idiot could think this piece is worth $58.4 million USD. The mind boggles, truly.

Of course, these enormous gains in the art market beg the questions, “Why now?” and “How long can this last?”

First, the why now. There have been a lot of people commenting on exactly who is buying art work for these incredible sums, and what their motivation is. Obviously it’s not just that they like art, but that it’s seen as an investment opportunity. It’s also worth noting that when prices at auction are this high it’s like the Dutch Tulip Craze – it doesn’t matter if it’s a volatile market, only if there’s someone willing to pay more – and with this kind of money changing hands, you’d be a fool not to get in on it, too if you have that kind of dosh to spread around. There’s a bit more to it than that, though – yes, there are hedge fund managers buying trophy pieces, but it’s not just the Wall Street 1% showing off their wealth. For instance, drug cartels are buying art to launder their money. Russian oligarchs are fleeing before Putin confiscates their money, and sinking that money into contemporary western art. Then of course there’s the fact that while historically auction houses have discouraged flipping, they now allow it – which not only drives up prices, attracting speculators, but if you roll your sales into a new purchase you don’t have to pay capital gains taxes on the original sale as it’s been re-invested. It’s not just about money to spend, but money to hide. All in all, it sounds pretty wild west out there.

As far as how long this can last, the short answer is simply that nobody knows, but with prices ramping up this quickly it’s making a lot of analysts nervous.

Basically, then, what we’re seeing sounds an awful lot like prices are going to keep spiralling ever upward until somebody flinches at the reality of the Emperor’s new clothes. With a glut of overvalued paintings on the market, prices will inevitably bottom out – where they come to rest is anybody’s guess, but at this point the art bubble’s collapse seems to be not so much a question of if, but when.

Share this: